The Ultimate Guide To Car Insurance Quotes

Wiki Article

The Best Guide To Renters Insurance

Table of ContentsWhat Does Renters Insurance Mean?4 Simple Techniques For Car Insurance QuotesThe 30-Second Trick For Life InsuranceRenters Insurance - The FactsTravel Insurance - The Facts

If your employer doesn't provide the type of insurance coverage you want, obtain quotes from several insurance coverage carriers. While insurance policy is costly, not having it could be far more expensive.It seems like a pain when you don't need it, but when you do need it, you're freakin' appreciative to have it there (medicaid). It's all about moving the danger here. Without insurance policy, you might be one automobile accident, illness or emergency situation far from having a huge money mess on your hands.

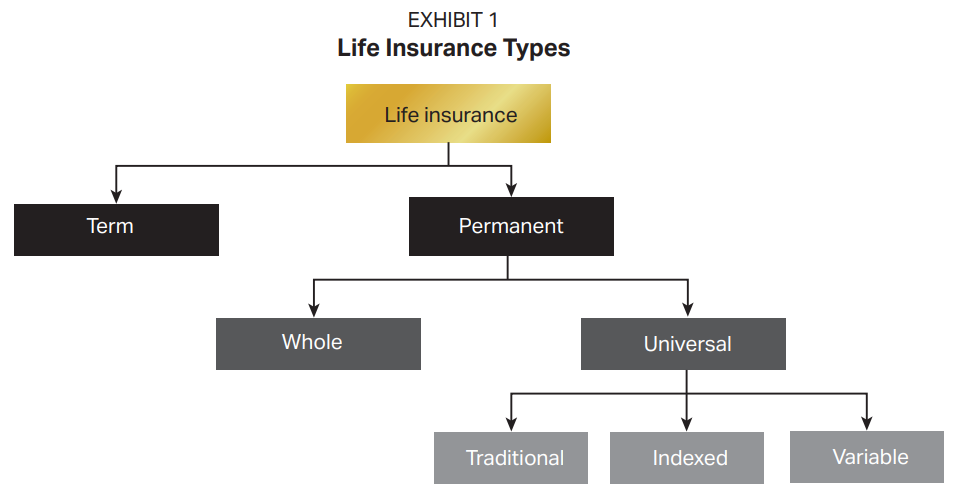

Have no fearwe'll break down everything you need to know regarding each of these types of insurance policy. Term Life Insurance Coverage If there's only one kind of insurance coverage that you authorize up for after reviewing this, make it term life insurance coverage.

Some Known Facts About Home Insurance.

Believe concerning this: The younger you are, the a lot more economical term life insurance policy is. All that to claim, if it's something you think you can use in the future, it's less costly to get it currently than in 15 years.Auto Insurance coverage You ought to never drive about uninsurednot just because it protests the legislation however likewise due to the fact that entering a minor car accident can be ex-pen-sive. The Insurance coverage Details Institute states the ordinary loss per case on cars is around $1,057. Imagine having to pay that kind of cash expense! The bright side is, you have actually obtained options when it comes to auto insurance policy, so there's no reason to avoid it.

And flood insurance coverage is likewise different than water back-up defense. A representative can aid you make sense of it all. If you do not live anywhere near a body of water, this insurance policy isn't for you.

A Biased View of Home Insurance

Bear in mind, if you don't have wind insurance coverage or a separate storm insurance deductible, your house owners insurance coverage policy will not cover storm damages. Depending on where you stay in the nation, quake insurance coverage may not be included in your house owners coverage. If you live in a location where quakes are known to drink points up, you might desire to tack it on your plan.Plus, a whole lot of proprietors and also apartment or condos will need you to have renters insurance policy also. A good independent insurance policy representative can walk you via the steps of covering the basics of both house owners and occupants insurance policy.

Do not put on your own because position by not having wellness insurance. The high expense of clinical insurance coverage isn't a justification to do without coverageeven if you don't go to the doctor a lot. To assist reduce on the price of health insurance policy, you might get a high-deductible medical insurance strategy.

You can invest the funds you add to your HSA, and they grow tax-free for you to make use of now or in the future. You can use the cash tax-free on competent medical expenditures like medical insurance deductibles, vision and also oral. Some business currently supply high-deductible wellness strategies with HSA accounts along with typical medical insurance plans.

Life Insurance - Truths

Insurance policy provides assurance against the unexpected. You can discover a plan to cover almost anything, however some are more crucial than others. It all depends upon your demands. As you map out your future, these four sorts of insurance coverage need to be helpful site firmly on your radar. 1. Car Insurance coverage Vehicle insurance is important if you drive.Some states additionally require you to carry individual injury defense (PIP) and/or without insurance driver coverage. These insurance coverages spend for medical expenses related to the event for you as well as your travelers, regardless of who is at mistake. This additionally aids cover hit-and-run mishaps as well as crashes with vehicle drivers who do not have insurance coverage.

This might come at a greater cost and with much less insurance coverage. That's because it guards you try this against expenditures for residential or commercial property damage.

In the occasion of a break-in, fire, or catastrophe, your renter's plan need to cover most of the costs. It may additionally help you pay if you have to stay in other places while your home is being repaired. Plus, like home insurance, tenants offers responsibility protection.

3 Easy Facts About Cheap Car Insurance Explained

That way, you can maintain your health and also wellness to satisfy life's demands.Report this wiki page